Aptos VS Solana VS EVM comparison

Aptos is a new layer one blockchain from Facebook’s original Diem development team. Aptos tend to keep Diem as authentic as possible. In contrast, Sui tends to improve Diem a step further.

This blog will compare Aptos with Solana and EVM in performance, reliability, tokenomics, and smart contract language.

Performance

Aptos

Aptos is inventing an innovation called Parallel processing. It allows multiple transactions to be processed simultaneously, in contrast to the traditional way of processing transactions one by one. It will enable a blockchain to have unlimited scalability.

The traditional way requires each node to process all transactions repeatedly, one block at a time, and each block contains multiple transactions. Although a block contains numerous transactions, each node picks these transactions from the same pool of pending transactions. Even though the node count doubled, there isn’t any performance gain as every node processes the same thing.

On the other hand, in Parallel processing, each node independently processes a different batch of pending transactions. For this reason, as the node count grows, the network will have more transaction per second throughput. Parallel processing is horizontally scalable by provisioning more nodes.

Aptos’ recent load-testing result has reached approximately 130,000 transactions per second. If implemented appropriately, Aptos can handle unlimited transactions per second relative to the number of running nodes.

Solana

Unlike any other chain that mostly utilizes Proof-of-stake, Solana believes that the root cause of the scalability problem relies on the consensus. So, Solana invents a novel Proof-of-history consensus along with Tower BFT, a PoH-optimized version of PBFT. Solana also utilizes other techniques and tools to get the title as a chain that can process most transactions per second using the cheapest gas fees before Aptos is launched.

Solana can process up to approximately 65,000 transactions per second. However, Solana may struggle to scale further due to its reliability and complexity. Currently, Solana is actively processing 3,000 transactions per second with $0.00025 gas fee per transaction.

Fantom

Fantom is an improved version of EVM in that each node is not processing the same transaction batch. Fantom’s deep technology enables parallel processing in the EVM chain by utilizing a directed acyclic graph (DAG) mechanism. Fantom uses a specialized consensus, Lachesis, an asynchronous Byzantine Fault Tolerance (aBFT) consensus algorithm developed primarily to enable parallel processing in its architecture.

Fantom has a significant performance gain in both transactions per second throughput and low gas fee. However, Fantom only achieves approximately 20,000 transactions per second, while Aptos can reach

Other EVMs

Other EVMs primarily process transactions in sequence. As mentioned in the Aptos section, every node processes the same batch of transactions. Even though the node count doubled, there isn’t any performance gain as every node processes the same thing. So, performance in other EVMs is terrible. For example, Ethereum can only process approximately 20 transactions per second. Otherwise, gas will spike.

Reliability

Aptos

Aptos has just launched its mainnet, so there isn’t enough data to measure the reliability of Aptos. However, it should be more reliable than Solana; otherwise, it will become a new meme.

Solana

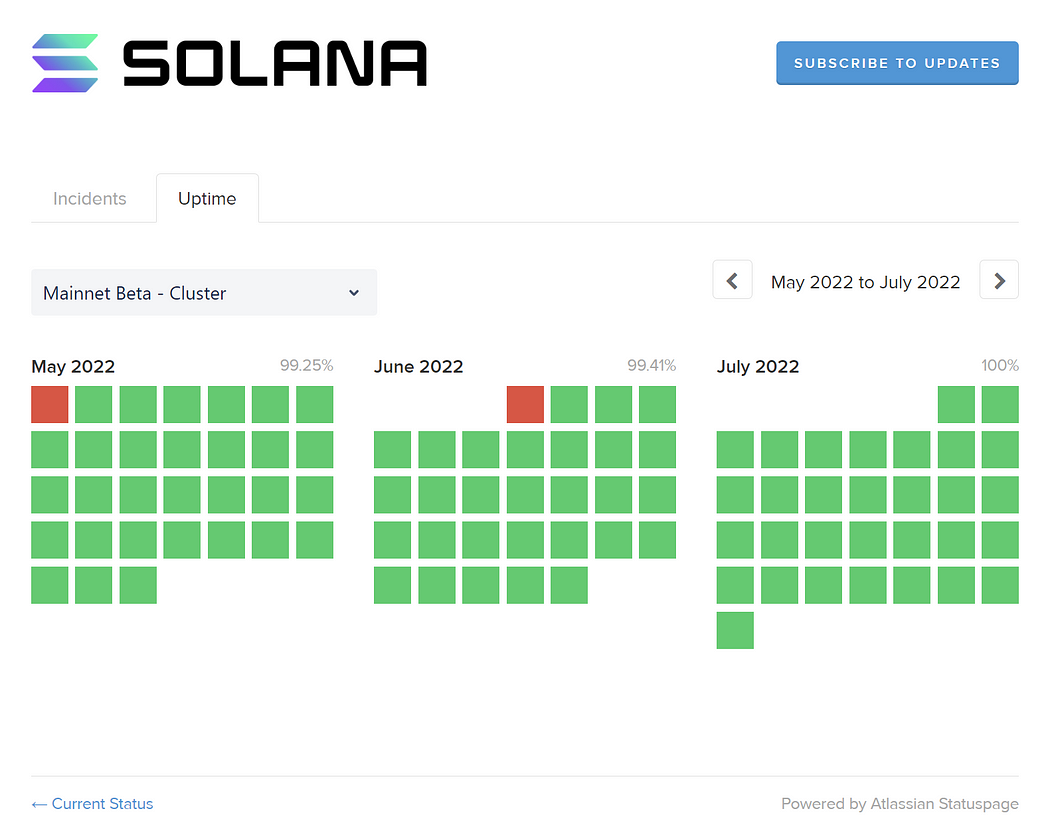

Solana is known to be highly unreliability. Many have said that Solana killer is Solana itself since it is down a lot throughout the year. Everyone can have a look at Solana’s uptime and downtime at https://status.solana.com/uptime.

Ethereum

Ethereum is the most reliable chain despite its poor performance and painful gas fee. Multiple validators around the world are operating the Ethereum chain. Even though one is down, there is no impact on the chain, as other validators will do the job instead. Ethereum never has downtime for a while.

Other EVMs

Other EVMs are not reliable as Ethereum. They usually use their novel customized techniques to increase their throughput and reduce gas costs. These techniques are new and not battle-tested. On a heavy load, these chains sometimes go down.

An example of Fantom outage news: https://fantom.foundation/blog/fantom-network-incident-analysis/

Tokenomics

Aptos

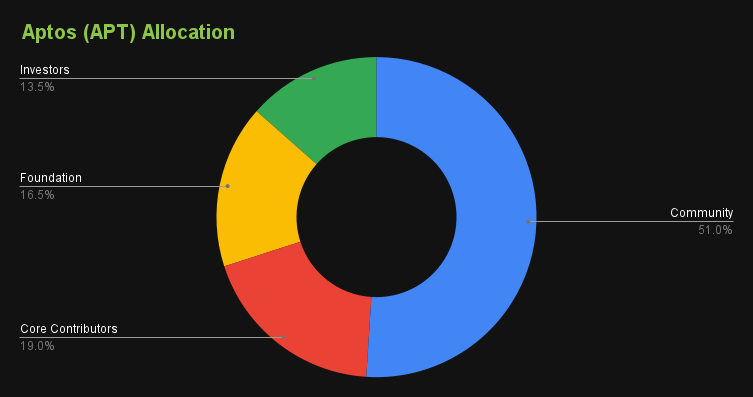

Aptos tokenomics is distributed to investors at 13.48%, the foundation at 16.5%, core contributors (team) at 19%, and a huge portion of 51.02% to the community. Aptos has airdropped 20M tokens (2%) to early users. The community also asks for a transparency report on how the remaining 49.02% community fund’s share is used.

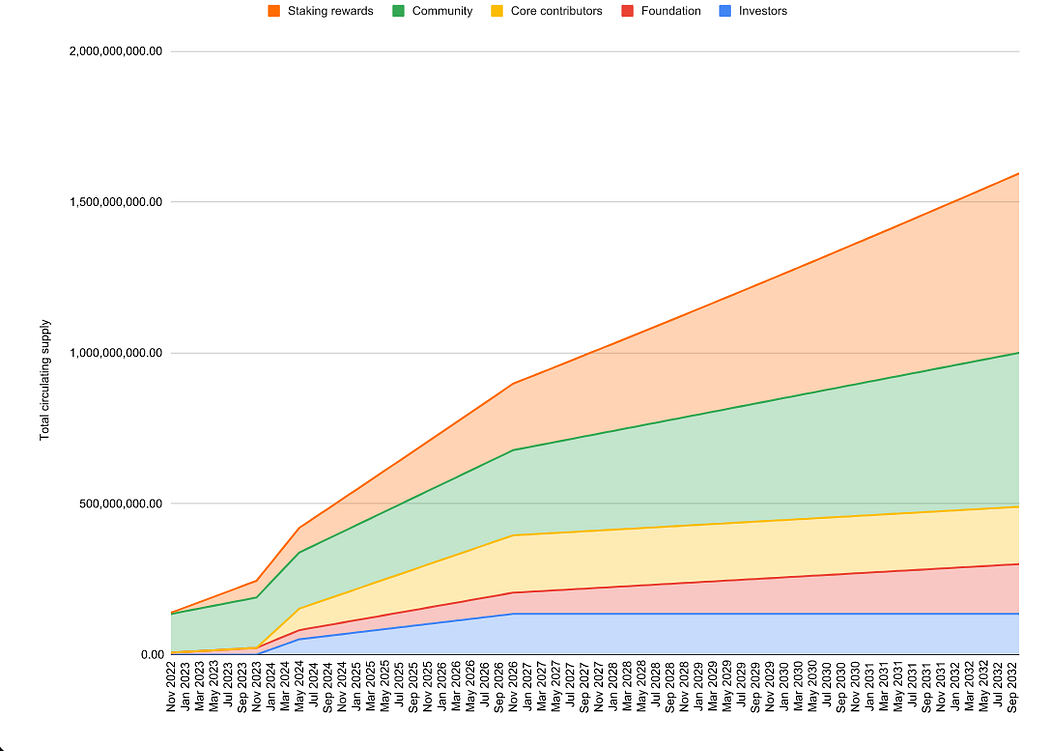

Aptos is utilizing Proof-of-stake with a validator reward from the inflation. This chart shows that Aptos circulating supply will reach 1 billion in 2024 and reach 1.5 billion in 2032.

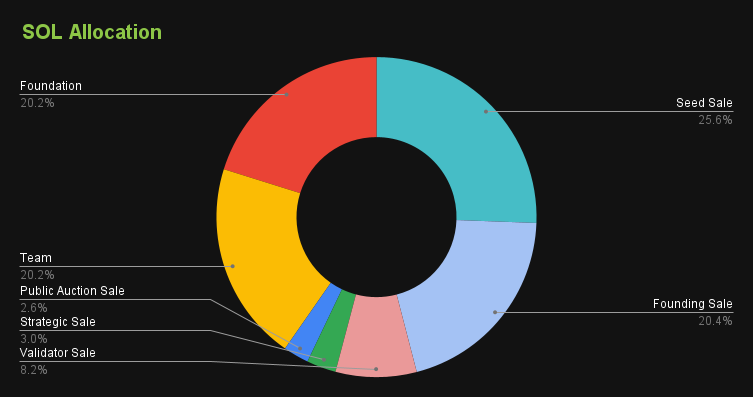

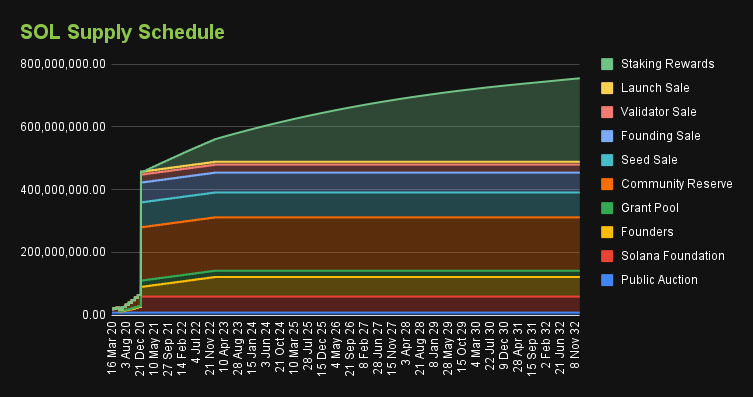

Solana, Fantom, Polygon, and most chains

Tokenomics is usually distributed to the team, foundation, private sale, and public sale. A chain that utilizes Proof-of-stake consensus is likely to have a validator reward from the inflation too.

Ethereum

Ethereum is designed to have an unlimited token. Ethereum has a foundation that distributes ETH tokens to developers who help grow the ecosystems.

Before Ethereum merge, Ethereum is utilizing Proof-of-work (POW) consensus. ETH token is given as a reward to the miner. This isn’t a great tokenomics design to start nowadays. Ethereum is an early adopter, and the crypto market cap is insufficient at launch, so Ethereum doesn’t have any other choices. However, after Ethereum merge, Ethereum is adopting proof-of-stake as most newborn chains are using.

Ethereum inflation is going down after the merge with a chance to become a deflationary token in the future. You can track the Ethereum inflation at https://ultrasound.money/.

Binance Smart Chain

Binance Smart Chain uses a one-time mint. BNB tokens are minted on genesis. Distributed to ICO buyers, Binance, and rewarded early contributors. BNB utilized Proof-of-staked-authority (PoSA) consensus. Validator reward comes entirely from transaction fees. BNB is a deflationary token as Binance actively uses its trading fees to burn BNB.

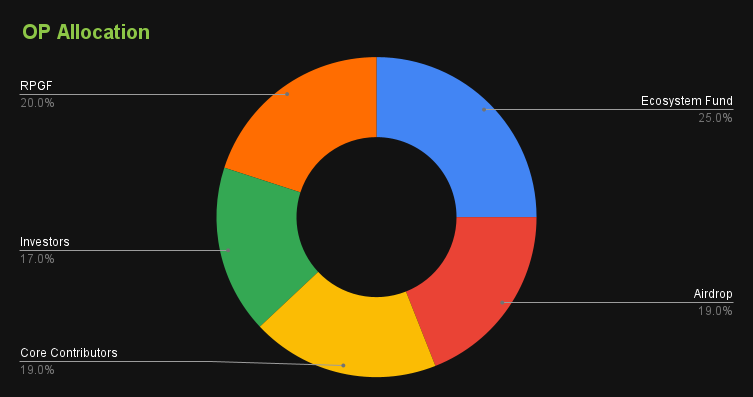

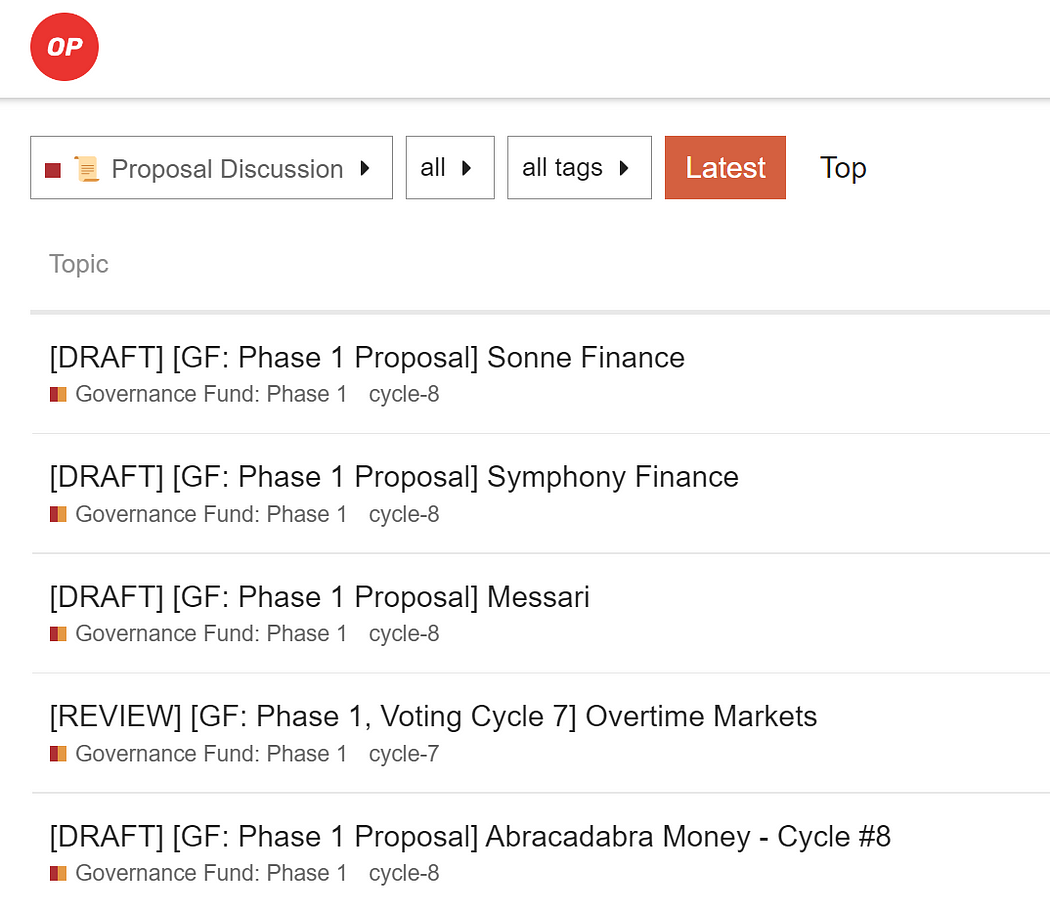

Optimism

Optimism tokenomics is similar to Solana, Fantom, and most chains. Except that it has a novel airdrop and grant mechanism. Optimism is the first chain with multiple airdrops and a transparent DAO to decide which projects should get the grant. It attracts both developers and users to use the Optimism chain and provides perfect matching between these two parties.

Smart contract language

Aptos uses Move as its primary smart contract programming language. It is designed especially for parallel processing. Comparison to Solana and EVM smart contract programming language can be concluded as follow.

- Data is stored within each owner’s account instead of in a program / smart contract. This plays a significant role in enabling parallelism. Data get sharded into different objects instead of being associated with an object.

- Parallelism is done automatically without any explicit specification required. Unlike Solana, where explicit specifying all accounts and programs accessed within the transaction is required. In EVM solidity language, parallelism is impossible.

- Transaction replay protection is similar to the EVM, where a sequence number (nonce) is used. In contrast, Solana uses transaction uniqueness and transaction remembering.

- Move language support generics (Have you seen SomeClass<K, V> in java? that’s called generic) while EVM Solidity doesn’t support it. Solana is using Rust, supporting generics as seen in this documentation but it isn’t widely used.

Summary

Aptos is a new layer one blockchain from Facebook’s original Diem development team. It has excellent performance compared to Solana and EVM. Aptos has reached approximately 130,000 transactions per second, Solana has reached approximately 65,000 transactions per second, and the fastest EVM, Fantom, has reached approximately 20,000 transactions per second. Since Aptos is a new chain, there isn’t enough data to measure its reliability. It should be much more reliable than Solana, a chain known to be down countless times throughout the year. However, Ethereum is still the most reliable chain despite its terrible performance. Aptos tokenomics isn’t extraordinary, and the community has raised many transparency concerns. While Optimism still holds the position for the best tokenomics design. Aptos uses Move as its primary smart contract programming language, designed especially for parallel processing. The most notable difference is that the data is stored within each owner’s account instead of in a program / smart contract.