History of major cryptocurrency exchange black swan events

The collapse of Mt.Gox

Mt.Gox is the first and largest bitcoin exchange during 2010–2014. By 2013, it controlled over 70% of all bitcoin trading volume worldwide. It was the target of the most significant hacking incident in history in February 2014, which resulted in the theft of around 850,000 BTC ($40 million at that time but $14 billion today). The exchange was forced to declare bankruptcy due to that incident in April of that year. This case has been open for multiple years and has yet to be concluded.

This notorious hack crashed the bitcoin price from $1160 in December 2013 to less than $400 in February 2014. Surprisingly, Bitcoin survives the reputational damage, with people blaming the exchange rather than the asset. One exchange has fallen, and others have grown, Bitstamp and Bitfinex.

According to the news, Mt Gox has announced a repayment program detailed in this letter. Those who are owed money by Mt. Gox have until January 10, 2023, to finish the first stage of the repayment procedures.

Bitfinex hack

Peer-to-peer Bitcoin exchange Bitfinex was established in December 2012 and provides users worldwide with trading services for digital assets starting with Bitcoin. In August 2016, Bitfinex got hacked. Hackers stole almost 120,000 bitcoins worth approximately $72 million, then $2 billion today. Luckily Bitfinex doesn’t go bankrupt and still operating nowadays.

Luckily, Bitcoin price only goes down a little from $600, reaching a low of $465 and bouncing back the next day.

The technique Bitfinex used to recover from this crisis is interesting. In summary, Bitfinex creates three tokens to handle this crisis.

- BFX token (BFX) is a debt token issued to any victim of the Bitfinex hack. It can be sold for $1 each or exchanged for shares in Bitfinex’s parent company, iFinex.

- Recovery Right Token (RRT) is later distributed to victims who exchange their BFX tokens for shares in Bitfinex’s parent company, iFinex. Bitfinex committed to distributing any recovered funds to RRT holders at $1 per RRT.

- UNUS SED LEO (LEO) is a token created to raise money to recover the loss during the hack. In LEO’s whitepaper, Bitfinex commits to using 80% of any funds recovered from the hack to buy back and burn LEO tokens. This token schema has lit up discussions about whether it is appropriate.

According to Bloomberg, bitcoin stolen during a 2016 hack of Bitfinex has been sized. The criminals have been arrested. However, there needs to be a clear plan for reimbursing affected users using these sized funds. But according to the whitepaper on raising money for their UNUS SED LEO (LEO) utility token, these recovered bitcoins are likely to use to buy back and burn the LEO token.

There is a protest against the LEO token scheme that only Bitfinex and their new investors benefit from the bitcoin price jump. But victims never benefit from the bitcoin price jump.

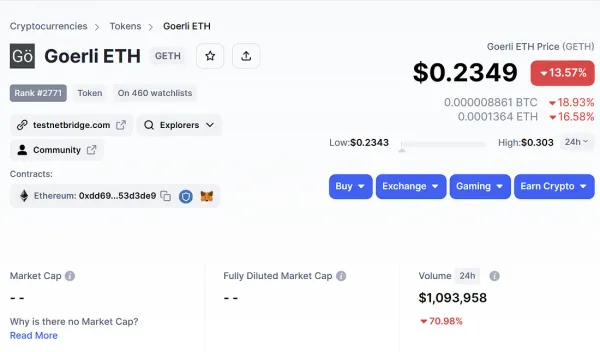

Coinbase’s stock crash

Coinbase stock price has fallen from its all-time high of $350 to $50 (Around 85%). That’s shocking. The reason is that Coinbase heavily relies on the crypto industry for exchange, ICO, and venture capital sectors. Since bitcoin has dropped around 75% from its all-time high, exchange volume has dropped significantly, nobody wants to buy newborn ICO tokens, and venture capital investment is illiquid. Coinbase and other exchanges struggle with profit. Moreover, they may struggle with cash flow if they have a venture capital arm.

Although the stock price crash of Coinbase is correlated to Bitcoin, it can be seen as a signal for other exchanges with low cash flow and projects that rely only on selling tokens. However, Coinbase is not crashing despite being on headline news for months.

The collapse of FTX

FTX used to be the second-largest cryptocurrency exchange in the world, but now it is fallen with its internal corruption. FTX had $900 million in liquid assets and $8.9 billion in liabilities before it filed bankruptcy, according to a report. That’s the largest exchange that has fallen in the crypto histories.

Sam Bankman-Fried founds FTX and Alameda Research. Alameda Research is famous for being an early investor in multiple top-tier projects, such as Solana. Given how much Solana depends on FTX, the price of SOL has dramatically fallen, and all tokens pegged by FTX, such as Wrapped Bitcoin (Sollet), have lost their peg.

However, Alameda Research is also infamous in the pump and dump schema, such as an investment in Reef finance. Alameda Research did an unusual thing by dumping REEF tokens immediately after receiving them.

It will be fine for FTX if Alameda Research invests using its own money. However, Alameda Research lends money from FTX to invest in projects, and FTX gives them the user’s deposited money! Later FTX is discovered to loan $10 billion of customer funds to prop up its trading firm, Alameda Research. After that, Alameda Research lends $1 billion back to Sam and $2.3 billion to his company. That’s a big fraud!

Everything began with a single tweet from CZ, CEO of Binance, announcing his intention to sell all his FTT tokens.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

This tweet sparked a worldwide panic sale of the FTT token and money withdrawals from the FTX exchange.

As a result, FTX experienced a challenging bank run situation. SBF took action by tweeting that FTX was fine and deposited funds were never used.

However, the fact is the opposite. Consequently, FTX has suspended its withdrawal system and deleted this tweet.

FTX send a letter to many VCs, including Sequoia Capital and Binance, to help reimburse their customers. Later, these VCs discovered that it had gone far beyond what they could help.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

The internal corruption hidden for a decade is yet to be discovered by public media. The first one is Dirty Bubble Media which warns about FTX ahead of the CZ’s tweet.

A story in two parts: https://t.co/jjWr7HaNsS pic.twitter.com/kbyxu5TPEw

— DIRTY BUBBLE MEDIA: GOOD LUCK, GOOD BYE. (@MikeBurgersburg) November 6, 2022

FTX has left no choice and is forced to fill Chapter 11 Bankruptcy Protection Filing to become officially insolvent. On the next day, FTX gets hacked, the balance is set to zero, and funds are transferred to the hacker’s wallet and converted into ETH. Later, The Securities Commission of the Bahamas acknowledged that it was behind the hack.

After that, the hacker swapped ETH for BTC, causing the market to crash furthermore. The collapse of FTX caused the bitcoin price to go down to a 2-years low of $16,000. Moreover, the collapse of FTX also causes many consequences and domino effects which we will discuss in the coming sections.

Corrupted proof-of-reserve

The fallen of FTX has raised public concern about the transparency of exchanges holding customers’ deposited funds. However, on-chain monitoring has shown some fraud.

According to this news, Houbi has a snapshot with a balance of around 14000 ETH but later moved to other wallets and left only around 2000 ETH in the wallet. This is abnormal behavior. However, on November 10, this wallet got refilled to 29000 ETH. You can track this wallet here.

Another suspicious activity is on the Crypto.com exchange. They transfer 320,000 ETH to gate.io by accident (that’s too much!). Luckily, gate.io transfer them back, but only 285,000 ETH. The community has suspected that they are sharing reserves to fake the snapshot.

BlockFi bankruptcy

BlockFi is a cryptocurrency lender directly affected by the collapse of FTX. BlockFi has recently paused the withdrawal and prepared for Chapter 11 Bankruptcy Protection Filing.

Genesis lending withdrawal suspension

Following the bankruptcy of FTX, the lending division of cryptocurrency investment bank Genesis Global Trading has temporarily suspended redemptions and new loan originations. The broker/dealer for Genesis Global Capital, Genesis Trading, is still fully operational.

If Genesis Trading went bankrupt, it would be another significant black swan event in crypto history, as there are rumors that genesis is related to multiple regulated exchanges in the US with vast liquidity. The most important one is Grayscale, the GBTC issuer.

Gemini Earn withdrawal delay

Genesis’ prohibition of withdrawals prevents Gemini Earn from withdrawing the underlying funds deposited into Genesis. As a result, users may be unable to withdraw their own money.