Lessons that we have learned from the FTX crisis

FTX crisis publicly started after CZ tweeted that Binance would liquidate all FTT tokens they have. However, the bubble has been growing up since the 2021 bull market. The main problem is that FTX gives users deposited funds to Alameda Research to invest in new crypto projects. Investing is an exchange between real money with a pile of illiquid tokens of that project. These tokens are not ready for sale for at least three years. Such an unlucky that the bull market ends in less than one year.

Leveraging works excellently in the bull market. In contrast, when a bear market comes, any party holding illiquid tokens is prone to fall. FTX and Alameda Research are one of them. We have listed lessons you should learn from this crisis in this blog.

Lessons for money management

Don’t put your entire lifesaving in an exchange account (Not your key, not your coin).

The recent FTX crisis has proven that exchange is unsafe for storing your coins. After you deposit your money into the exchange, the exchange controls the key. So, the actual owner of that money is the exchange, not you. The exchange can do anything to that money, including buying a penthouse, investing in another project, and other fishy actions.

FTX recently went bankrupt and stole money from everyone. In comparison, Binance has a long history of locking innocent users’ funds without a meaningful reason other than being investigated by the FBI. We have discussed the binance locking fund in our blog.

You must learn to store your money securely.

Many people store their money on the exchange as they feel secure. They think exchanges are just like banks, where someone secures your funds and resolves any case if your fund gets stolen. However, it doesn’t. They may lock or steal your fund at any time. Moreover, you never know how they will use your fund.

You should use a hardware wallet to store your money securely. The most popular hardware wallet is Ledger. If you want even more security than a hardware wallet, you should learn Gnosis Safe, which we will discuss in the coming blog.

Don’t over-leverage

Leveraging earn you a big profit if you are lucky, but if you are unlucky, you lose everything. In most cases, leveraging only works on a short-term basis. So, if you are a long-term investor, forget about using leverage or being rekt. FTX not only utilizes their user’s money but also leverages it by using their FTT token as collateral to borrow a stablecoin. FTX is giving this money to Alameda Research to invest in early projects. Since these projects are early, invested capital isn’t yet liquid. Combined with their leverage, they lose big bucks long-term and run out of money to pay back their users. However, if they invest using their fee only, they may win in the long term, and this crisis won’t happen.

An example of leveraging is future trading. You may need to watch this video to see its dangers.

There is no “Too big to fall.”

FTX used to be the second-largest exchange in the world. Currently, it is insolvent and has drained all customer’s funds. Another well-known case is Luna. So, there is no “too big to fall.”

Act instantaneous when you smell something fishy

When you hear any bad news from a trusted source, act fast. You don’t need to think about what is behind the scenes. Just act!

In the FTX situation, you will survive if you immediately follow the news and withdraw your money from the exchange. On the other hand, you will lose all of your money if you disregard it.

Similarly, in Luna’s case, you will only lose a little money if you cut the loss early. If you don’t, you may lose all your money.

Recap:

— DIRTY BUBBLE MEDIA: GOOD LUCK, GOOD BYE. (@MikeBurgersburg) November 13, 2022

- cryptodotcom sent 320k ETH to Gate

- Gate sends 285k back

Now: CEO RESPONDS SAYING THEY ACCIDENTALLY SENT IT THERE AND ASKED FOR IT BACK????

GTFO OF CRYPTO DOT COM https://t.co/xGXGT3OnGI pic.twitter.com/mzWaCrpMQY

Crypto exchanges are faking the attestations. https://t.co/Fe58x2IiQM

— Bitfinex'ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) November 13, 2022

Lessons for investors

Smart people don’t guarantee success

In 2021 and 2022, there is a trend in the investment industry to overly value everyone who graduated from MIT, Ivy League, and former FAANG employees. Top-tier VCs give millions of dollars to them even before they start developing the project. However, the performance is not impressive. Most projects built by them survive entirely on selling their token to VC. These projects never get any profit. These people tend to be nerds, thus lacking any business and marketing skills necessary to drive a project.

On the other side, smart people from third-party countries such as Thailand and Vietnam never have a chance to get any seed investment necessary to bootstrap a project. No matter how smart they are, they hardly get any seed investment from top-tier VCs. The only way to get investment is to gain impressive real tractions, which looks impossible as your project is likely to get copied by a wealthy organization and attacked by offering incentives that you can’t.

Don’t invest in projects that rely on selling their tokens instead of profit

Most crypto projects in 2021 and 2022 (Even with some CEX) rely on selling their tokens instead of profit. A project’s market cap should be low if it depends on token sales, while a project that generates actual revenue will have a high market cap. This system is made to encourage people to invest in early-stage tokens so they can profit from their future. At the same time, another group of investors relies on low-risk investments in successful projects. However, crypto projects in the 2021 bull run tend to have an extremely high market cap despite not earning any profit.

It is hard to justify whether a project can depend on its profit in the future. Predicting the future requires expertise in that field and business. However, if you correctly identify them, you can profit considerably.

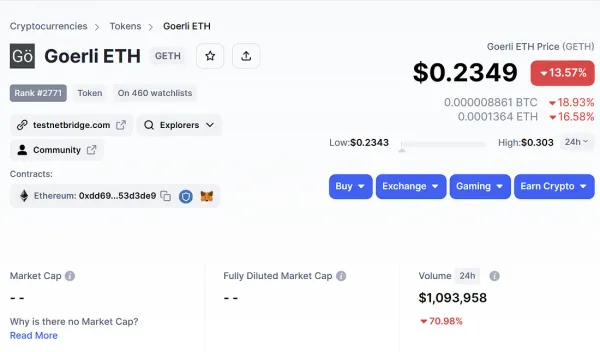

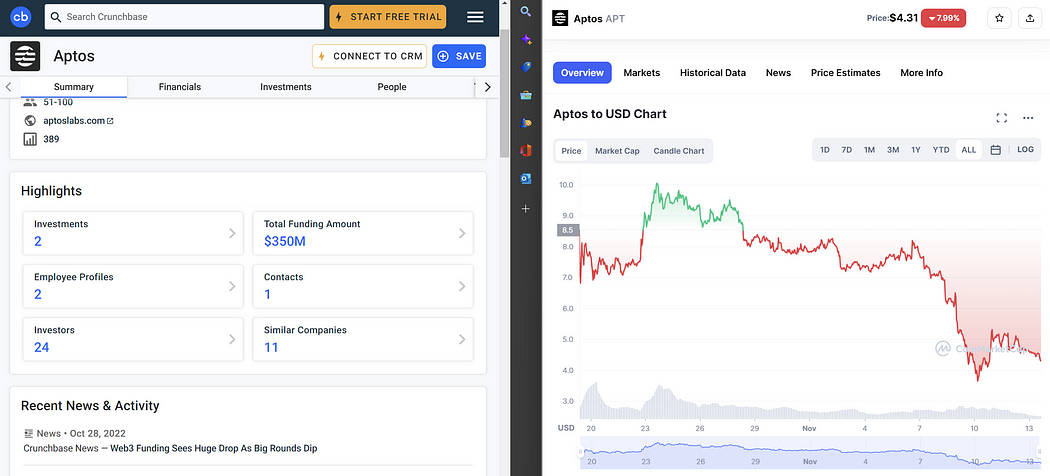

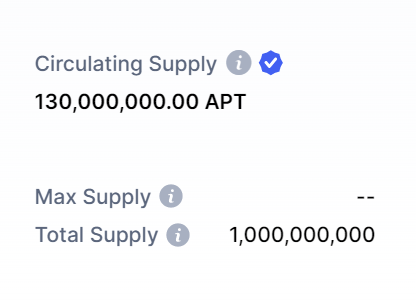

Be careful with projects with a small circulating supply compared to the total supply

Having a small circulating supply compared to the total supply is a bad sign for a project. In the future, more tokens will be unlocked and dumped into the market, causing the price to drop further. With an exception, if a project can gain profit more than its inflation, it looks good, but only a few projects can do that.

Lessons for business owners

Refrain from binding your business to a single entity

ฺฺฺBinding your business to a single entity is risky. If that entity has fallen, your business is also fallen. For example, if your business survived entirely using only funds from FTX or Alameda Research paid monthly. As FTX and Alameda Research are related entities, if one has fallen, your business may face a financial crisis as monthly funding has gone away.

Don’t use your governance tokens as collateral

Most projects usually mint a large pile of their governance tokens to themselves to position them as the largest shareholder. Using their tokens as collateral to borrow a large pile of stablecoins has many bad consequences. If their token price crash, they may be liquidated, and their token price will drop more, causing cascading liquidation loop that significantly impacts the token price. These projects usually rely on their token rather than profit, so the price drop affects the project’s stability. Combining cascading liquidation and FUD spread across social media, the project is easily insolvent.

Alameda Research uses FTT as collateral to lend stablecoins from Abracadabra and FTX itself!

Focus on profit, not token price

Traditional businesses focus on profit rather than their stock price. Their stock price and valuation are related to their profit multiplied by a P/E ratio. In contrast, the token price and valuation of most crypto projects in the 2021 bull run are given by the speculation of VCs. As a result, these projects are extremely overvaluation, and their price relies on market makers rather than profit. This is a giant bubble that is unhealthy for the entire crypto ecosystem. Finally, VCs involved in this bubble will lose their money and eventually become insolvent if they continue this behavior. Some of them, such as 3AC, FTX, and Alameda Research, are currently insolvent.